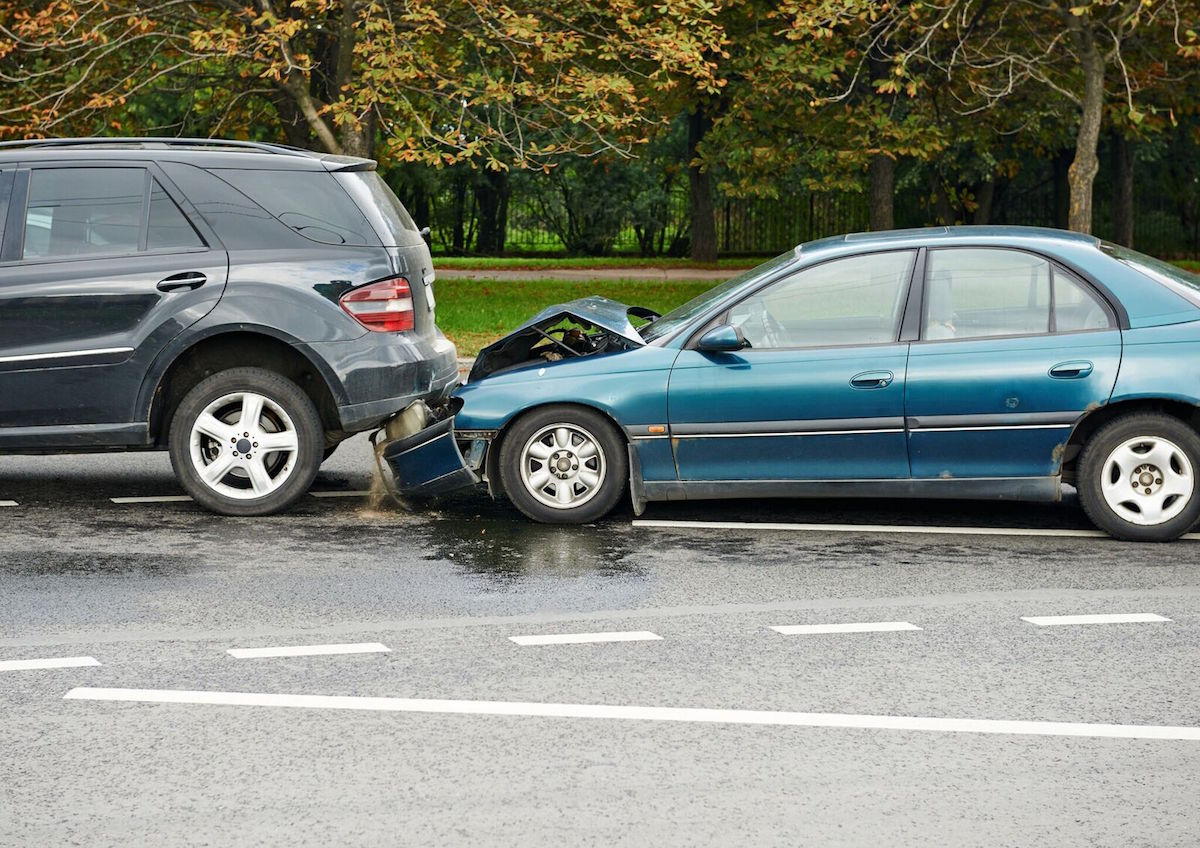

You were just driving along the city streets one night and then came along a wayward driver, putting you and your car awry. Consequentially, there’s a lot to be considered: medical expenses, car repair, legal, and work compensations for when you’re absent. That’s a lot of stress and expenses involved for something you didn’t even expect! Financial help for car accident victims can be obtained from various sources, but some are afraid that it will not be a viable option. Fortunately, you need not worry.

Look for Lighter Loans

Scrutinize the myriad of institutions offering such loans. If not wary, you might end up with a bigger pain in the rear than the accident you were supposed to cover for. Asking is an important action to this end, as you may uncover otherwise hidden charges that you may have not known.

A compensation for something you didn’t intend to happen shouldn’t be costlier than the accident itself. Be aware of the entailed costs, and the payment schemes and conditions. Because of the inevitable damage an accident can do to your livelihood, you should be aware that you may not have the means to repay the loan even if you get back to working order.

Know The Details

Always analyze the fine print. Never sign loan papers unless you’re absolutely sure you are okay with every last detail, both written and implied. Once again, it never hurts to ask. Ask the agent about what’s included in the loan you’re about to take. Make them explain the finer details of the loan. It is your right as a customer.

Also, do background check on the prospective loaning institution. Sift for reviews, look for their performance history. Make sure you are loaning from a reliable and trustworthy source. Sometimes, the loaning institution found just around the corner can be more reliable than the one found in Wall Street.

Legal support

Lastly, an attorney can help with the matters greatly. He/she can leverage the case to the bank, which in turn may grant you easier time settling a loan. Keep in mind that losing the case should be a no-pay situation. Aside from that, an attorney can also help you know what should and should not be in a loan, potentially avoiding pitfalls.

Reliable legal support can be the difference between a loan you can comfortably pay, or one that’s going to be a burden for the rest of your life.